Az State Tax Form 2025. This rate applies to taxable income earned in 2025, which is reported on state tax returns filed in 2025. See free file alliance and a free direct file option is coming soon.

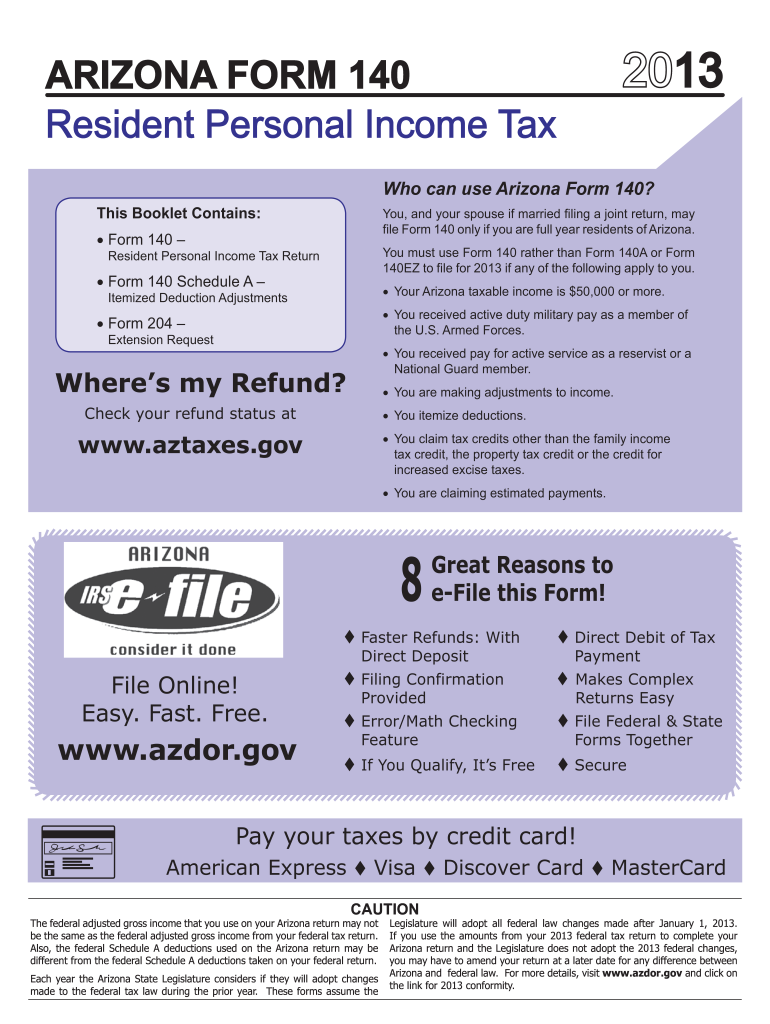

Arizona consolidated its four income tax brackets into two brackets in 2025. To estimate your tax return for 2025/25, please select.

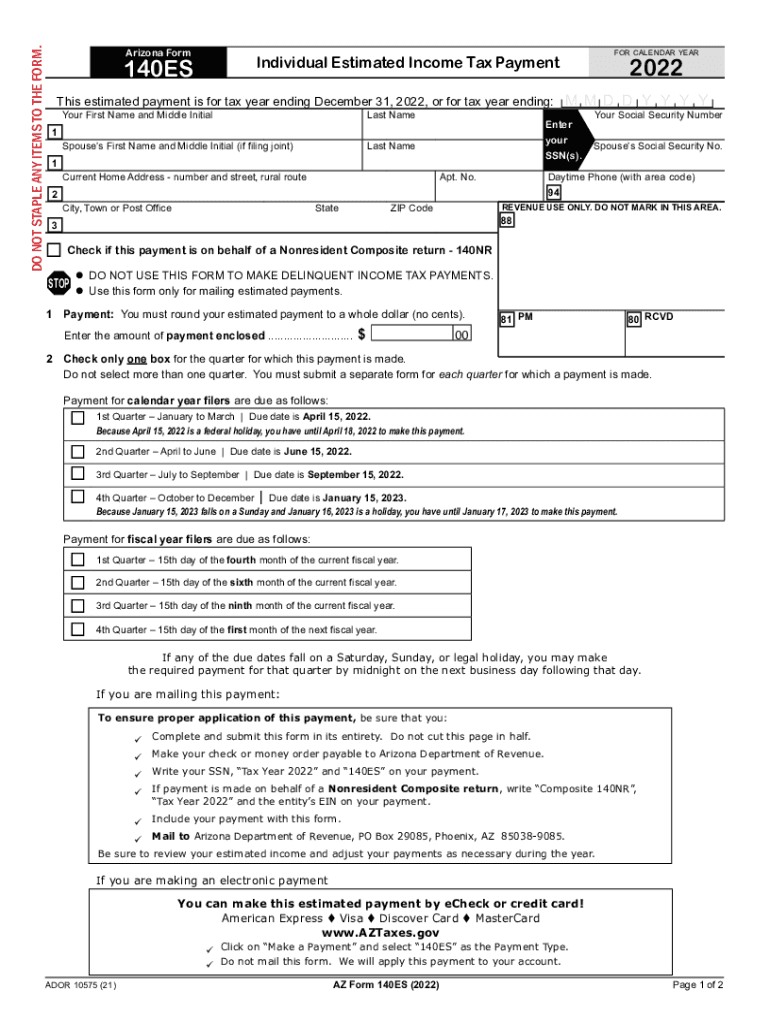

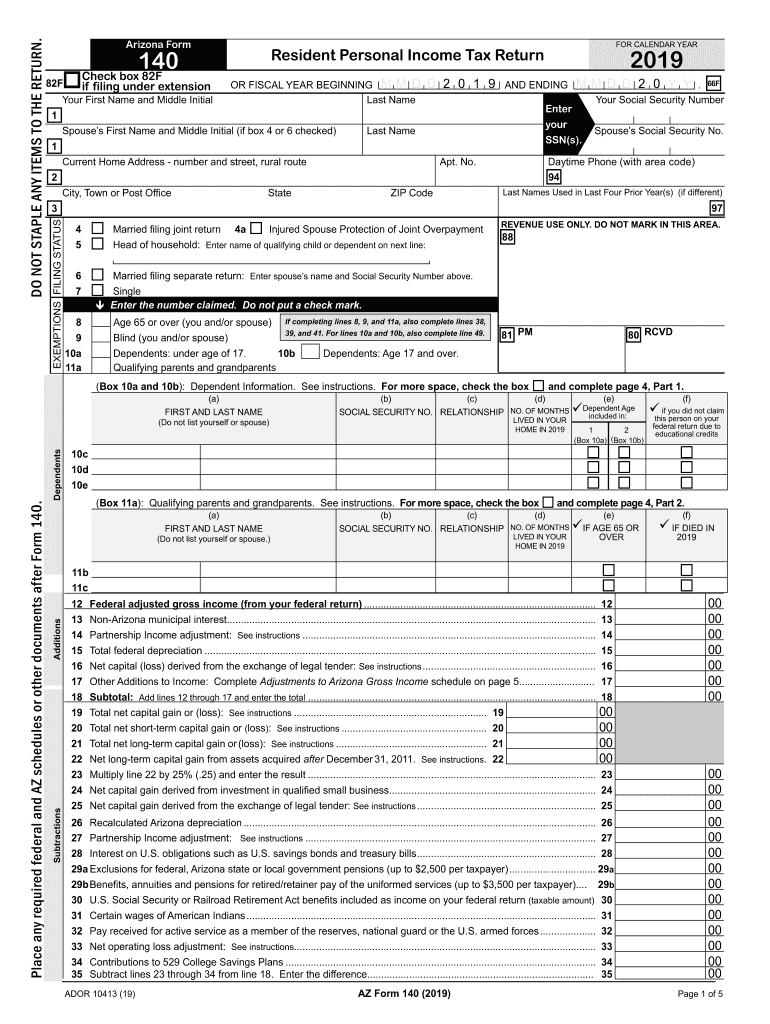

Arizona Estimated Tax Payments 20222024 Form Fill Out and Sign, This rate applies to taxable income earned in 2025, which is reported on state tax returns filed in 2025. Arizona form for calendar year.

Edit az Fill out & sign online DocHub, The arizona state tax calculator (azs tax calculator) uses the latest federal tax tables and state tax tables for 2025/25. Who pays arizona income taxes?

Arizona Tpt 1 Fillable Form Printable Forms Free Online, Tax credits and deductions for individuals. The arizona department of revenue (dor) and code for america announced a landmark partnership giving eligible arizona individual taxpayers a new.

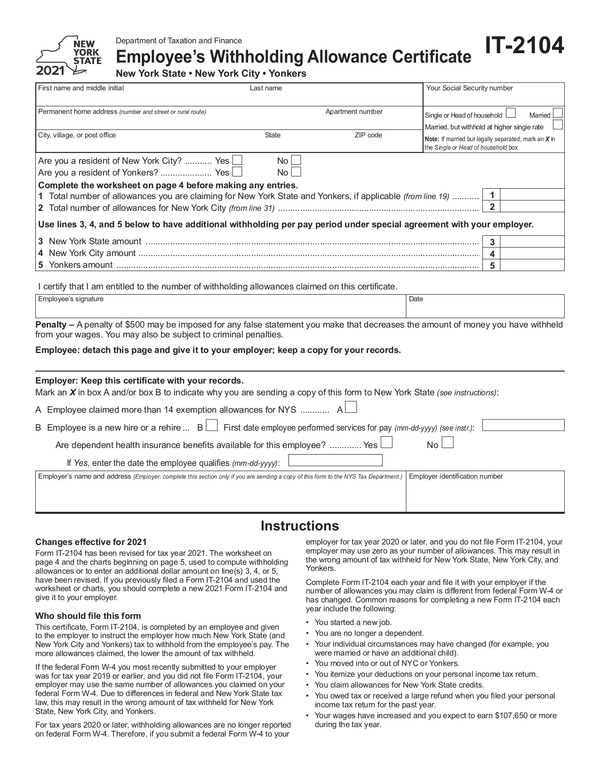

Free Printable State Tax Forms Printable Templates, Previous versions of the form are not valid for withholding calculations as of january 1, 2025. The annual salary calculator is updated with the latest income tax rates in arizona for 2025 and is a great calculator for working out your income tax and salary after tax based on a.

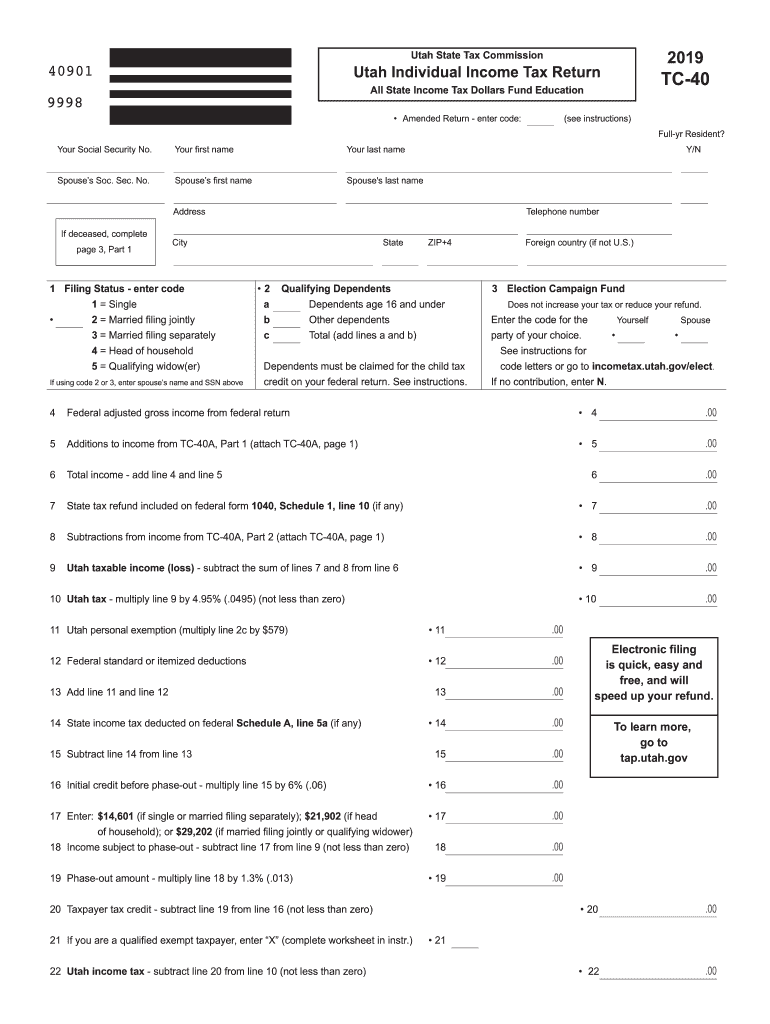

Utah state tax forms Fill out & sign online DocHub, Click here for more information. Arizona residents state income tax tables for widower filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

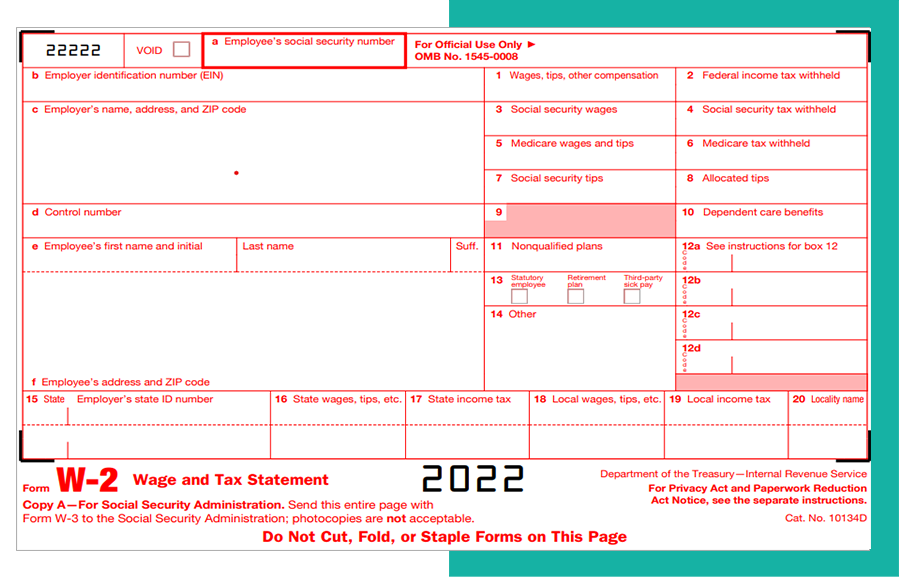

Arizona Tax Filings Requirements Efile 1099/W2 for the Arizona State, The arizona state income tax rate is 2.5%. This rate applies to taxable income earned in 2025, which is reported on state tax returns filed in 2025.

Az 140 fillable form Fill out & sign online DocHub, To estimate your tax return for 2025/25, please select. Taxpayers have additional options this year for filing their individual tax return for free!

Fillable Online Arizona Taxes and AZ State Tax Forms eFile Fax, The arizona state income tax rate is 2.5%. Arizona residents state income tax tables for widower filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

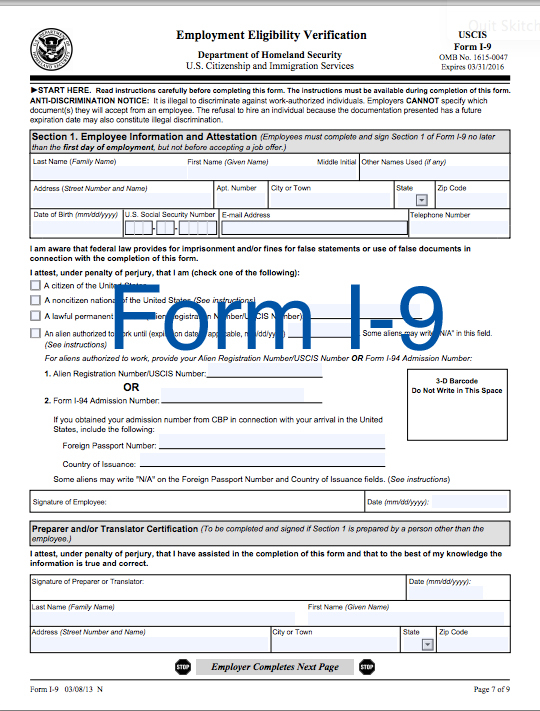

New 2025 I9 Form Pdf Pauly Betteann, Arizona’s income tax for the year 2025 (filed by april 2025) will be a flat rate of 2.5% for all residents. Aztaxes.gov only supports internet explorer 10 and 11, google chrome and mozilla firefox.

2025 Az State Withholding Form, 26 rows individual income tax forms. • for tax year 2025 estimated tax payments, the tax rate for estimating your tax liability is 2.5%.

The arizona department of revenue is reminding businesses to renew their 2025 transaction privilege tax license through aztaxes.gov.